Table Of Content

But, for a conventional loan, you need 20% for the down payment to avoid private mortgage insurance (PMI). MoneyGeek’s Texas mortgage calculator presents a general estimate of your monthly mortgage payment using 12 relevant factors. We broke down each of the factors below to help you understand them better. At 1.80%, Texas has the 7th most expensive property tax rate in the United States; the average cost per year for property taxes is $3,907.

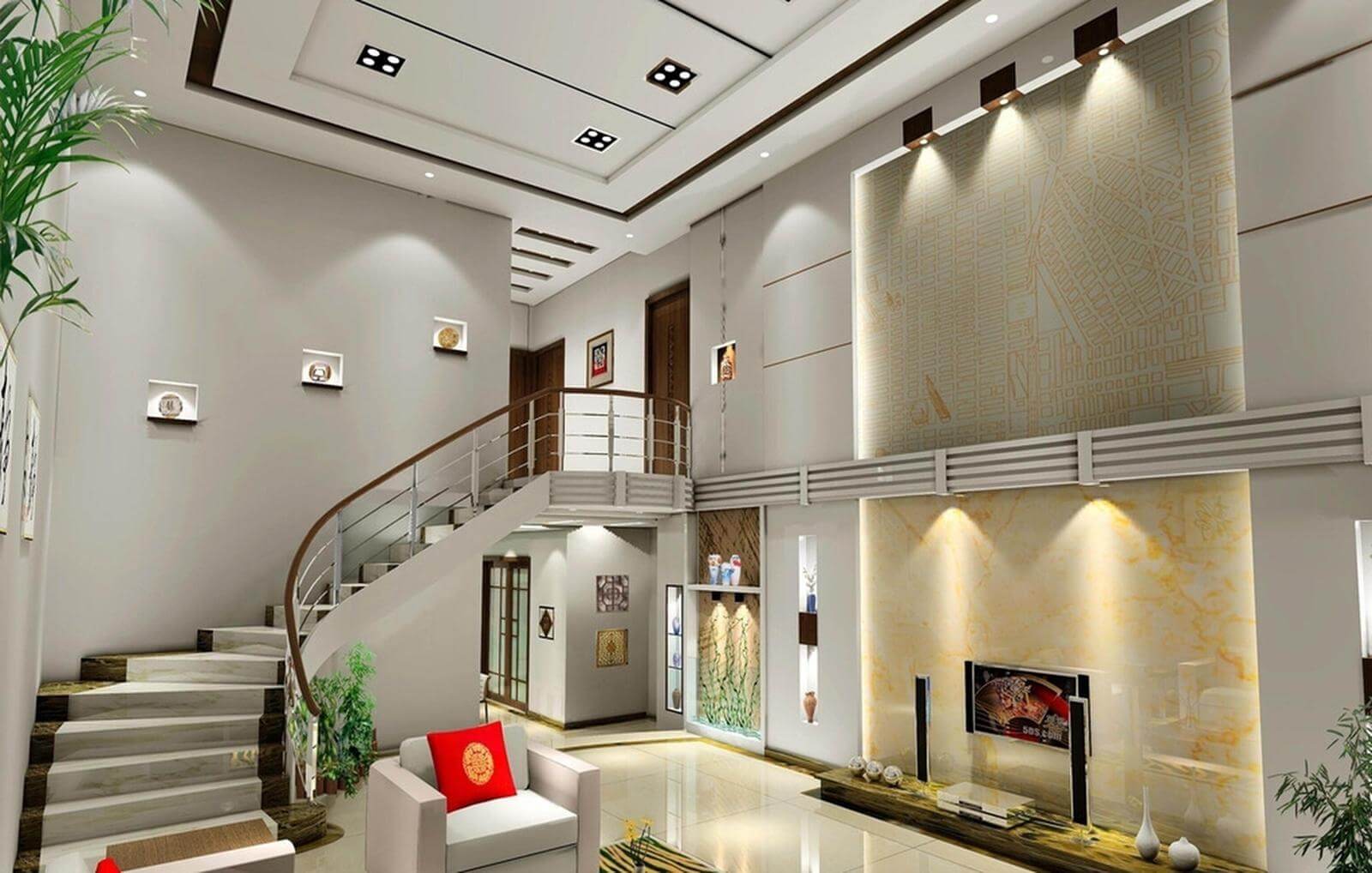

Start your home buying research with a mortgage calculator

Find out how much housing, utilities, food, transportation, health care and taxes cost in the Lone Star State. The principal is the amount that pays back the loan, while the interest is the money you’re paying to the lender for providing the loan. Want a quick way to determine how much house you can afford on a $40,000 household income? Use our mortgage income calculator to examine different scenarios. See how much your mortgage payment would be by state based on the calculator inputs above.

Sample loan programs

Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. First-time home buyers may find it difficult to come up with a 20% down payment. After all, a down payment in Texas would be around $72,000 based on the median Texas single family home sales price in July 2023. You'll also have to budget for closing costs, move-in costs, and other expenses. Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment.

How much you need to make to afford a $600000 home - Fortune

How much you need to make to afford a $600000 home.

Posted: Fri, 10 Feb 2023 20:53:02 GMT [source]

Title Insurance Premium

The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features. As for what the cost of living difference will be if you’re relocating to Texas, it’ll depend on what area you’re looking at. For example, if you and your partner are moving from New York City to Dallas and you have a pre-tax combined income of $110,000, your cost of living will be 26% lower in Texas on average. In that case, the cost of living in the same scenario is about 23% lower on average.

A financial advisor can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial planning - including retirement, taxes, insurance and more - to make sure you are preparing for the future. However, homes that sold above list price are decreasing, with just 20.8% doing so in July 2023, down significantly from 38% the same period in the prior year. Texas struggled with maintaining supply of all home types throughout much of the early pandemic, but is starting to see a tiny bit of uptick in options for buyers. In July 2023, there were three months of supply, 127,127 homes for sale, an increase of 3.1% over the same period the year prior. Change the home price in the loan calculator to see if going under or above the asking price still fits within your budget.

Calculate mortgage rates

Buyers in Texas may include radon testing and mitigation as part of their home inspection process, considering the potential costs of these additional services. By addressing radon concerns early on, buyers can make informed decisions and ensure the safety and well-being of their future homes. Home insurance rates in Texas are higher than the national average, with an average annual cost of $4,142 compared to the national average of $2,777.

Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. A quick conversation with your lender about your income, assets and down payment is all it takes to get prequalified. But if you want to get preapproved, your lender will need to verify your financial information and submit your loan for preliminary underwriting.

Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Closing costs are another expense you’ll have to consider before buying a home.

Details of Texas Housing Market

Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. Using an online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. It can also show you the total amount of interest you’ll pay over the life of your mortgage. This is generally shown as an annual percentage of the outstanding loan. For example, a 5% interest rate on a $200,000 mortgage balance would add $833 to the monthly payment.

Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance.

Whether you’re buying or selling a home, you want to make sure you’ve got all your ducks in a row! Do a little research on the front end to find the ones in your area that will. On mobile devices, tap "Refine Results" to find the field to enter the rate and use the plus and minus signs to select the "Loan term." Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

You can also add additional fees like property taxes, homeowners insurance and homeowners association (HOA) dues. Here are the factors every potential home-buyer needs to know that our mortgage calculator includes. Homeowners in Texas pay $1,137 on average for a monthly mortgage payment. A home loan has many variables, though, which affect how much you could pay.

In Texas, this means you'd need to set aside an additional $300 to $1,200 per month on average to cover maintenance and upkeep if you're buying a home today. In the first years after you buy your home, your remaining balance will be quite large, and so will your interest payments. Over time, as you pay down the remaining balance, your interest payments will get smaller and you'll start to make quicker progress toward paying off the loan. Check out this list of the best rated mortgage lenders to find a great rate for that Texas home purchase. The single family housing market in Texas is holding steady, with a median price at $360,000 in July 2023, a drop of just 1.5% over the same time the year before.

You can find links to advice, government agencies that provide help and the Homeownership Preservation Foundation (HOPE Hotline) on the Texas Department of Housing and Community Affairs website. Buying a home is expensive, even before you take out the mortgage itself. There are forms and deeds to be filed away, inspections to pay for, reports to check, and more.